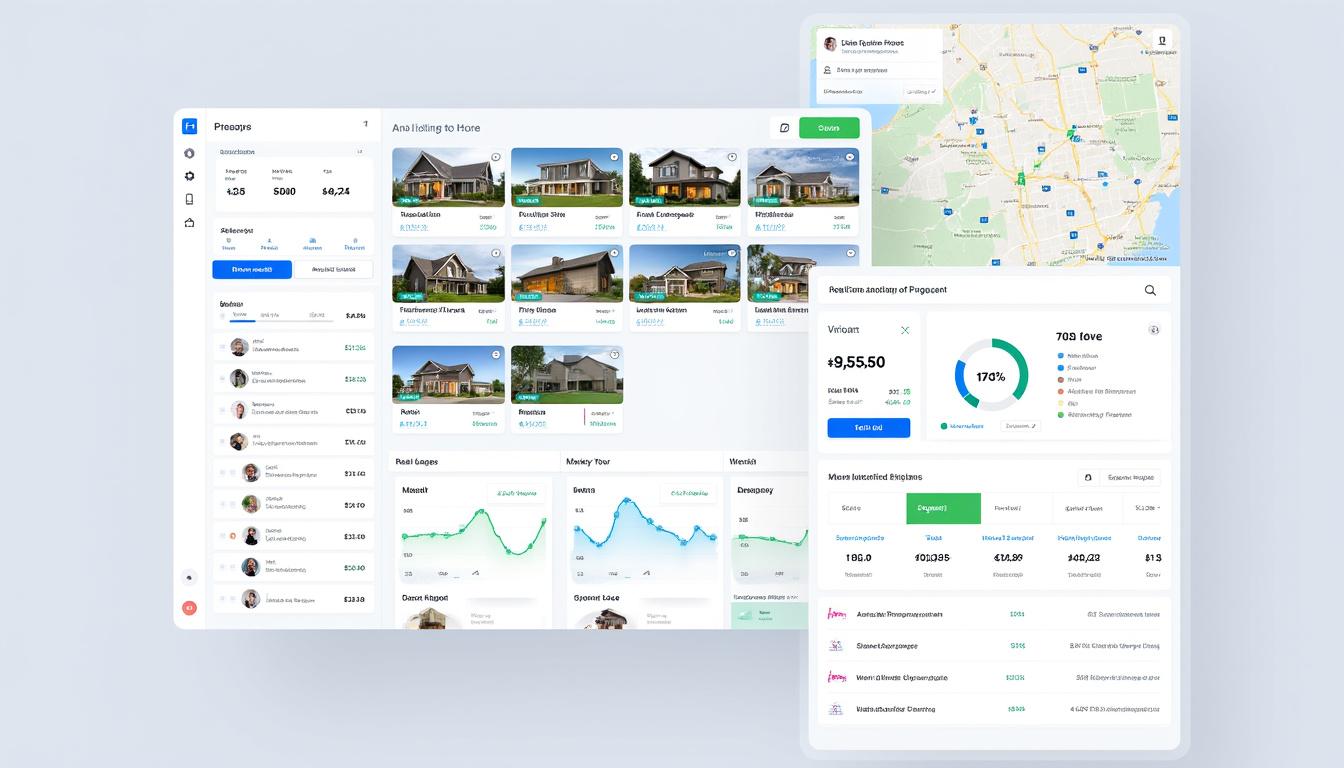

Discovering the vibrant landscape of online real estate businesses for sale reveals a dynamic intersection of technology and property management. These enterprises leverage digital platforms to streamline property transactions, engage global clients, and enhance operational efficiencies. As more entrepreneurs aspire to enter or expand within this sector, the demand for accessible, well-structured online real estate businesses grows. Various marketplaces such as BizBuySell, LoopNet, and Transworld Business Advisors offer extensive listings, highlighting diverse opportunities ranging from brokerages to property management firms. This spectrum underscores the multifaceted potential inherent in online real estate ventures and the lucrative prospects for investors in 2025.

Encompassing nuanced market insights and cutting-edge digital innovations, the realm of online real estate business sales demands astute attention from prospective buyers. Platforms like Flippa and Empire Flippers specialize in vetting and facilitating the purchase of web-based property firms, while industry giants such as FE International and Website Closers provide expert brokerage services ensuring secure transactions. The surge in SaaS-driven real estate solutions and app-based service models further accentuates the transformative nature of online real estate marketplaces, reflecting an amplified blend of technology and traditional brokerage practices that redefine how properties are bought, sold, and managed globally.

Key Considerations When Choosing an Online Real Estate Business for Sale

Selecting the right online real estate business to purchase requires a comprehensive understanding of various crucial factors that impact the profitability and sustainability of the investment. The high variability in online business models demands that buyers assess specific metrics and operational aspects carefully to align acquisitions with their strategic goals. A well-informed evaluation can differentiate between transient opportunities and lasting value.

- Market Niche and Business Model: Online real estate businesses may specialize in different segments like residential brokerage, commercial leasing, property management, or real estate SaaS platforms. Identifying a niche that matches the buyer’s expertise or interests enhances the likelihood of success.

- Financial Health and Growth Trends: Essential indicators include revenue streams, profit margins, and historical growth data. Businesses with diverse income sources, such as commission-based sales combined with recurring management fees, typically demonstrate stronger resilience.

- Technological Infrastructure: The backbone of any online real estate enterprise is its digital platform. Buyers should evaluate website performance, user interface quality, and integration with CRM or marketing tools to ensure scalability.

- Customer Base and Market Reach: Engagement levels, client demographics, and geographic coverage influence business sustainability. Enterprises with established repeat customers or a global footprint often hold greater appeal.

- Legal and Regulatory Compliance: Real estate markets are subject to stringent regulations varying by jurisdiction. A thorough review of licenses, contracts, and compliance protocols is indispensable.

For practical guidance, many prefer engaging consultants from renowned marketplaces like Transworld Business Advisors or GlobalBX to navigate these complexities. Additionally, comparative analyses on platforms such as BizQuest can pinpoint competitive advantages or gaps in available offers.

| Criteria | Importance Level | Evaluation Metrics |

|---|---|---|

| Revenue Diversity | High | Multiple income streams, recurring revenue share |

| Software Platform Quality | High | User experience, speed, mobile compatibility |

| Market Penetration | Medium | Client base size, repeat transactions |

| Legal Compliance | High | Licenses validity, contract reviews |

| Operational Complexity | Medium | Staff requirements, automation level |

Ultimately, acquiring an online real estate business implies embracing both the nuances of real estate markets and the advancements of digital technology. Buyers must perform thorough due diligence, harness platforms like FE International or Website Closers for expertise, and consider emerging options such as online business sales focused on real estate to secure promising ventures.

Popular Marketplaces for Purchasing Online Real Estate Businesses

The ease of access to online real estate businesses for sale extensively depends on the availability and reliability of specialized marketplaces. These platforms serve as critical intermediaries, ensuring transparency, due diligence, and broad visibility for sellers and buyers alike. Each marketplace excels in different facets, addressing diverse buyer requirements.

- Flippa: Known for a vast array of online businesses, Flippa features numerous real estate websites and apps aggregated for easy browsing and comparison.

- BizBuySell: Distinguished by comprehensive listings, BizBuySell focuses on detailed financial disclosures and provides professional advisory services for real estate sectors.

- LoopNet: Primarily a commercial real estate platform, LoopNet integrates business-for-sale listings, emphasizing physical property bundles with online management capabilities.

- Empire Flippers: Catering to higher-end web properties, Empire Flippers specializes in vetted, profitable real estate businesses, often with SaaS or subscription models.

- Digital Exits and Website Closers: These platforms target technology-driven real estate ventures, including software tools and lead generation sites.

- Transworld Business Advisors: A long-standing firm with deep real estate expertise providing holistic brokerage and consultancy services.

- BusinessesForSale.com and GlobalBX: Offering a global scope, these marketplaces adapt to international clientele searching for diverse geographic opportunities.

Navigating these marketplaces involves scrutinizing listing quality, peer reviews, and support services. Examples reveal distinct approaches: Flippa might list smaller, emerging websites perfect for first-time buyers, whereas Empire Flippers and FE International often handle transactions exceeding seven figures. Recent trends in 2025 show an increase in SaaS-based real estate business listings, reflecting the sector’s pivot to digitally managed, subscription-driven services.

| Marketplace | Main Focus | Typical Listing Types | Transaction Range |

|---|---|---|---|

| Flippa | Wide variety of online businesses | Real estate portals, apps, lead gen sites | $10K to $1M |

| BizBuySell | Traditional and online real estate firms | Brokerages, property management, agencies | $50K to $5M+ |

| LoopNet | Commercial real estate | Property bundles, management platforms | $100K to $10M+ |

| Empire Flippers | Profitable SaaS & subscription models | Real estate software, memberships | $100K to $3M |

| Digital Exits | Tech-driven real estate platforms | Lead gen, MLS software | $50K to $2M |

| Transworld Business Advisors | Full-service business brokerage | All types, emphasis on established firms | $100K to $10M+ |

Prospective buyers might explore additional resources such as high-quality website listings dedicated to business sales to broaden their search spectrum and identify hidden gems. Understanding marketplace nuances enables investors to pinpoint ideal opportunities aligned with their strategic ambitions.

Technology Trends Shaping Online Real Estate Business in 2025

By 2025, technology continues to revolutionize the online real estate domain, driving new business models and operational efficiencies. Emerging trends reshape how buyers and sellers interact with digital real estate ventures, fostering innovation across platforms.

- AI-Powered Property Matching: Advanced algorithms analyze buyer preferences and market trends to personalize property suggestions, significantly reducing search time and elevating user satisfaction.

- Virtual and Augmented Reality Tours: VR and AR enable immersive viewing experiences, allowing prospective clients to explore properties remotely with high-fidelity simulations.

- Blockchain and Smart Contracts: These technologies enhance transparency and security in property transactions, automating contract execution and reducing fraud risks.

- Mobile-First Solutions: Optimized apps and responsive interfaces cater to increasing mobile traffic, enabling transactions and communication on the go.

- Integrated SaaS Platforms: Comprehensive software solutions combining CRM, marketing automation, and analytics streamline real estate business management.

Such technological advancements underpin business models listed on platforms such as BizQuest and FE International, shaping the offerings available for sale. Consider the hypothetical example of a property management SaaS that integrates AI-driven lead generation with blockchain-secured contracts, thereby attracting investors looking for cutting-edge capabilities and reduced operational overhead.

| Technology | Main Benefit | Impact on Business Model |

|---|---|---|

| AI Property Matching | Enhanced personalization, reduced search time | Subscription models, increased user retention |

| VR & AR Tours | Immersive viewing, wider audience reach | Higher conversion rates, premium service tiers |

| Blockchain Smart Contracts | Secure, transparent transactions | Lower transaction costs, trust enhancement |

| Mobile-First Design | Accessibility anywhere, anytime | Expanded market access, improved communication |

| Integrated SaaS Platforms | Operational efficiency, centralized management | Scalable subscription revenues, better analytics |

Entrepreneurs eyeing online real estate businesses can gain competitive advantage by prioritizing these technologies when evaluating opportunities. Resources like AI-driven business listings reveal the increasing convergence of real estate and artificial intelligence in current market offerings.

Financial and Legal Factors Influencing Online Real Estate Business Sales

Every acquisition within the online real estate sphere is shaped not only by market potential but also by nuanced financial and legal factors. Scrutinizing these underpinnings is essential to secure a viable, lawful, and profitable transaction, especially given the regulatory heterogeneity across territories.

- Valuation Methods: Online real estate businesses are often valued using a multiple of EBITDA or seller’s discretionary earnings, adjusted for recurring revenue strength and growth prospects.

- Due Diligence Processes: Comprehensive audits covering financial statements, traffic analytics, intellectual property rights, and software integrity minimize post-purchase risks.

- Licensing and Compliance: Regulatory compliance involves verifying brokerage licenses, fair housing laws, and data privacy adherence—critical for trust and operational legitimacy.

- Contractual Obligations: Existing client agreements, vendor contracts, and employee terms may carry liabilities or be subject to renegotiation, influencing acquisition strategy.

- Tax Implications: Jurisdictional tax considerations affect profitability and can define deal structure, including asset versus stock purchases.

Professional advisories found through platforms like FE International or Transworld Business Advisors frequently assist buyers in navigating these complexities, offering structured transaction frameworks and post-sale integration plans. For budding investors or those looking to diversify, consulting detailed investment guides such as those at business sale resources proves invaluable.

| Factor | Risk Level | Mitigation Strategies |

|---|---|---|

| Financial Verification | High | Third-party audits, escrow arrangements |

| Regulatory Compliance | High | Legal counsel review, regulatory checks |

| Contractual Liabilities | Medium | Contract analysis, renegotiation clauses |

| Tax Considerations | Medium | Tax advisor consultations, deal structuring |

The intersection of financial prudence and legal diligence ultimately crafts a foundation for sustainable success in online real estate business ownership. Engaging specialized brokers at regions with growing real estate markets offers additional competitive advantages for international buyers and sellers.

Marketing Strategies to Boost Performance of Online Real Estate Businesses

Robust marketing approaches are essential to amplify visibility and revenue in the competitive online real estate domain. Successful enterprises leverage data-driven strategies and emerging digital tools to attract, nurture, and convert leads effectively.

- SEO Optimization: Tailoring content and site architecture around targeted keywords such as “online real estate business for sale” improves organic search rankings and draws qualified traffic.

- Content Marketing: High-value blogs, market reports, and video tours enhance authority and engagement, fostering trust among prospective buyers and sellers.

- Social Media Campaigns: Managed outreach via LinkedIn, Facebook, and Instagram targets specific demographics, especially millennials and Gen Z first-time buyers.

- Email Nurturing Sequences: Automated drip campaigns maintain client relationships and encourage repeat business or referrals.

- Paid Advertising: Platforms like Google Ads and native advertising strategically amplify exposure with measurable ROI.

These methods, supported by analytic dashboards integrating real-time metrics, enable operators to iterate and optimize marketing efforts. Platforms including BizQuest, Empire Flippers, and Digital Exits provide valuable insights into successful marketing tactics for online real estate businesses. Exploring resources such as business sales websites uncovers detailed case studies illuminating marketing successes.

| Marketing Channel | Purpose | Key Metrics |

|---|---|---|

| SEO | Increase search visibility | Organic traffic, keyword rankings |

| Content Marketing | Credibility and client engagement | Time on page, conversion rates |

| Social Media | Targeted audience reach | Engagement rates, follower growth |

| Email Marketing | Lead nurturing and retention | Open rates, click-through rates |

| Paid Advertising | Amplified exposure | Cost per lead, ROI |

These multi-channel marketing strategies form the cornerstone of accelerating business performance, attracting investments, and maximizing exit values. Aligning marketing with operational capabilities creates a virtuous cycle fueling sustainable growth in the online real estate business market.

What factors should I consider before buying an online real estate business?

Consider market niche, financial health, technological infrastructure, customer base, and legal compliance. Evaluating these aspects ensures alignment with your investment strategy and reduces risk.

Which marketplaces are best for purchasing online real estate businesses?

Platforms like Flippa, BizBuySell, LoopNet, Empire Flippers, and Transworld Business Advisors are some of the most reputable, each catering to varied business sizes and models.

How does technology impact online real estate businesses today?

Technologies such as AI-driven matching, VR/AR tours, and blockchain smart contracts enable enhanced customer experiences, security, and operational efficiency.

What legal considerations are important in online real estate business acquisitions?

Ensuring proper licensing, compliance with real estate and privacy laws, verification of contracts, and tax planning are critical components of risk management.

How can marketing strategies boost online real estate business sales?

Effective SEO, content marketing, social media, email campaigns, and paid ads increase visibility, engagement, and lead conversion, driving overall business growth.